Insurance Jargons. Terms You Need To Know

Insurance Jargons

Terms You Need To Know

Welcome back, fellow insurance aficionados. In this instalment of our journey through the insurance world, we're going to dive into the secret language of actuaries, underwriters, and anyone who's ever uttered the phrase "deductible" without flinching.

Ironically, we're not going to tackle the hefty topics like underwriting or actuarial science today — those require their own dedicated articles. Instead, we're keeping it simple, focusing on the essential terms you need to know to comprehend a conversation around insurance.

So, without further ado, let's dive into the world ofDeductibles insurance lingo and make sure you're equipped to hold your own at the next industry happy hour.

Policy holder

Explanation: This is the person who buys the insurance policy and pays the premium.

Beneficiary

Explanation: The person who receives the payout from the insurance.

FAQ: Won't the policy holder always be the beneficiary of the policy?

While usually true, in certain cases the policy holder may not be the beneficiary. For e.g., In a life insurance, you purchase the policy and pay the premium, therefore, you are the policy holder. However, in case of your death, the payout of the policy goes to someone in your family making that person the beneficiary.

Premium

Explanation: This is the amount of money you pay to an insurance company (aka insurer), usually every month or year, to keep your insurance policy active.

Example: If you have a health insurance policy, you might pay ₹5,000 per year as your premium. This payment ensures that your insurance coverage remains in force.

FAQ: What factors affect the premium of an insurance policy?

There are a lot of factors that go into deciding your insurance premium. A few of them are:

- Type of Insurance: Different policies have different bases for premium calculation. For instance, life insurance is priced differently from motor insurance.

- Coverage Amount or Sum Insured: More coverage means a higher premium.

- Policy Term: Longer coverage periods usually mean higher premiums.

- Age & Lifestyle: Younger, healthier people generally pay less. If you're a skydiving enthusiast, though, that might bump up the cost!

- Health & Medical History: Pre-existing conditions can increase your premium or lead to certain exclusions.

- Features & Add-ons: Customising your policy with extras like zero deductibles can increase the premium.

- Frequency of Payment: Paying annually might cost less overall than paying monthly.

- Claim History: If you've made multiple claims in the past, your premium might go up. Conversely, a no-claims bonus can reduce your premium.

Sum Assured (SA) or Sum Insured (SI)

Explanation: This is the amount of money that the insurer promises to pay when defining an insurance policy.

Example: If your life insurance policy has a sum assured of ₹50 lakhs, then in the event of your passing, your beneficiary will receive, this sum from the insurer.

Claim

Explanation: A claim is a formal request made by the policyholder to the insurer asking for payment based on the terms of the policy. There are 2 major types:

- Cashless Claim: This is a type of claim where the insurer directly settles the bill, and you don't have to pay out of pocket (except for non-covered expenses). This is usually only covered in the insurer's network hospital/garage etc so always check the coverage before you pick the insurer.

- Reimbursement Claim: This is a type of claim where you pay for the bill out of your own pocket and then submit the bills and necessary documents to the insurer for reimbursement. If the process is done right, you receive the amount in typically 2–4 week (varies from insurer to insurer)

Deductibles

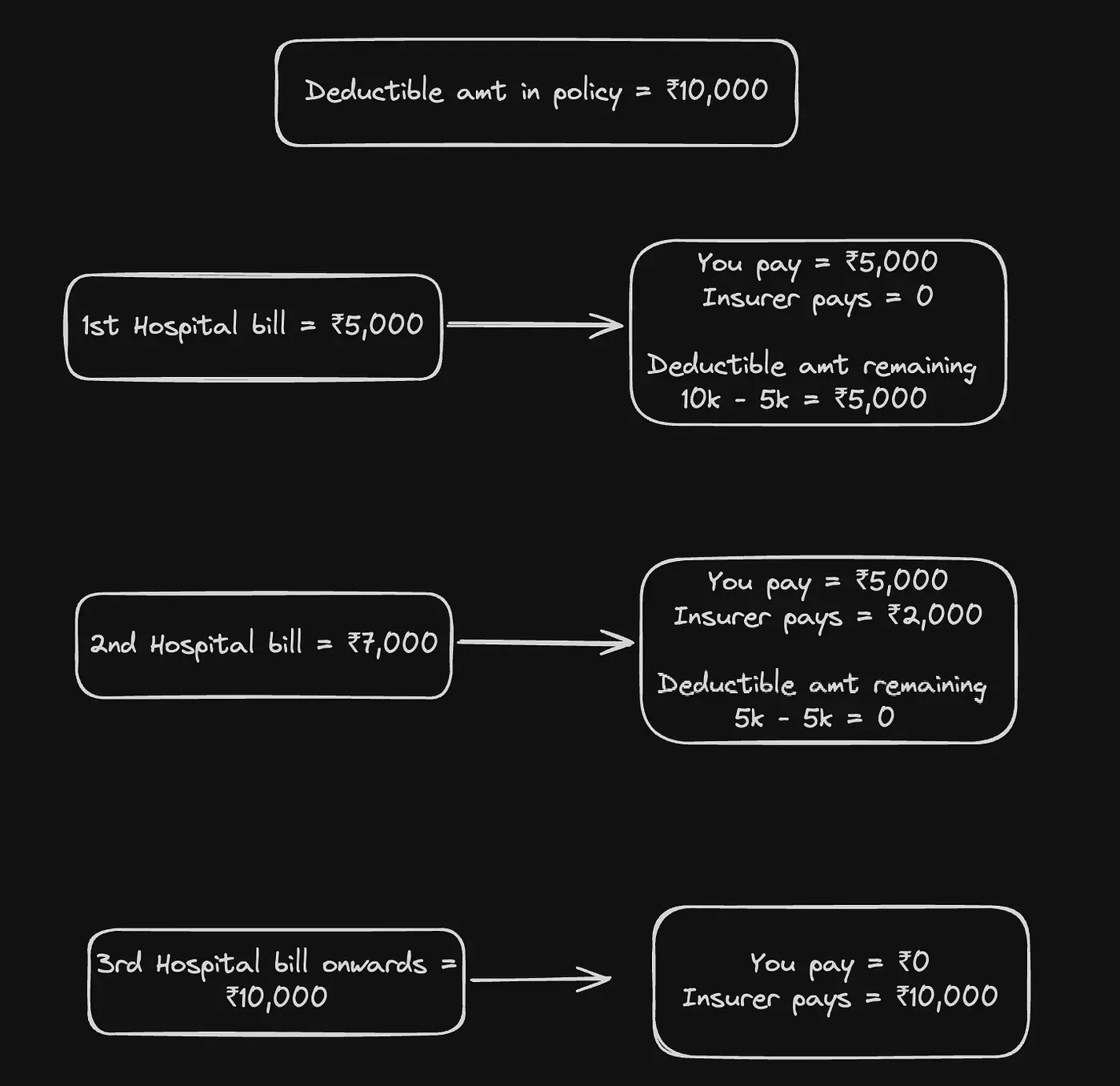

Explanation: This is the amount of money you must pay out of your own pocket before the insurer starts paying for a covered loss.

Example: Say you have a health insurance policy with a ₹10,000 deductible, and your hospital bill is ₹5,000. You'd cover this amount yourself, reducing your deductible to ₹5,000. If you incur another ₹7,000 bill, you'll pay ₹5,000, and your insurer will cover the remaining ₹2,000.

Deductible image.webp

FAQ: Why would anyone opt for a deductible?

To reduce the premium. If you're confident you can handle smaller expenses, a higher deductible can lower your premium cost. But it's a bit like gambling — only do it if you're sure you won't need frequent payouts.

Co-Payment (Co-pay)

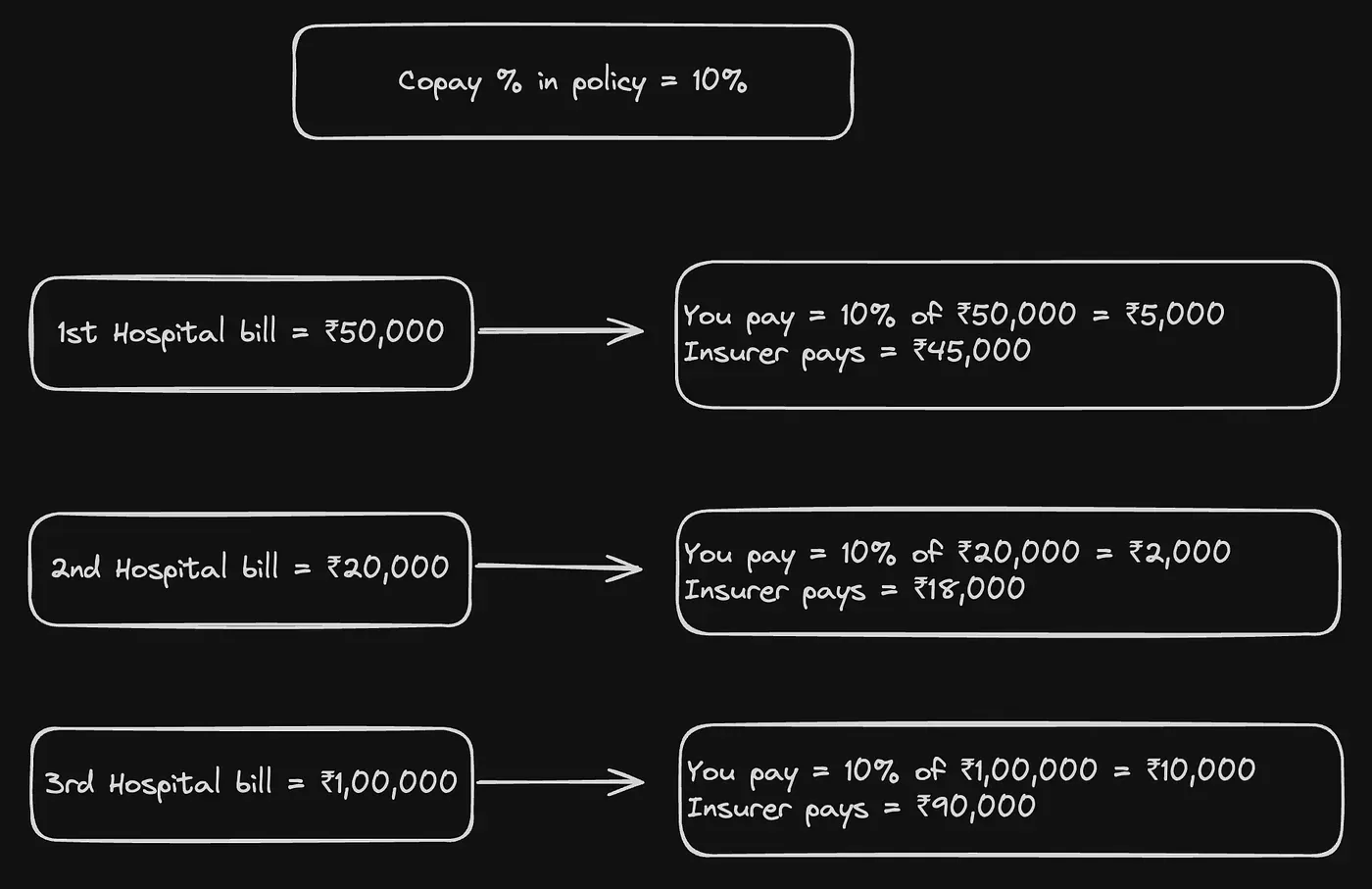

Explanation: Co-pay is the portion of the claim amount that the policyholder must pay out of pocket for every medical, with the insurer covering the rest. This is also done to reduce the overall premium.

Example: Say your health insurance has a 10% co-pay and you have a hospital bill of ₹50,000. Here, you would pay ₹5,000 (10% of ₹50K), and the insurer would cover the remaining ₹45,000.

Not so fun fact: This applies to each and every bill that you claim within the policy's term.

Copay example.webp

FAQ: How is a co-payment different from a deductible?

A deductible is a fixed amount you pay within a year or policy term before the insurer starts covering costs. Co-pay, on the other hand, is a percentage of each bill you're responsible for — kind of like splitting the bill at a restaurant, but the insurer picks up the larger tab.

Rider

Explanation: This is an additional conditions you can add to your basic insurance policy, for an extra premium. It's like adding toppings to a pizza.

Example: You might add a critical illness rider to your life insurance policy, which would provide a lump sum payout if you are diagnosed with a serious illness like cancer. This can help with your medical bills or can act as an income source if you're not able to work due to the condition.

FAQ: Do I really need a rider?

It depends on your situation. If you think you need extra protection (like for critical illness or accidental death), a rider can be a good idea. But if the basic policy covers all your needs, you might skip the extra cheese.

No-Claim Bonus (NCB)

Explanation: This is basically a discount or reward given by the insurer if you do not make any claims during the policy term or a defined time frame (like a year).

Example: If you don't make any claims on your car insurance for a year, you might get a discount on the next year's premium. It's like getting a gold star for good behaviour!

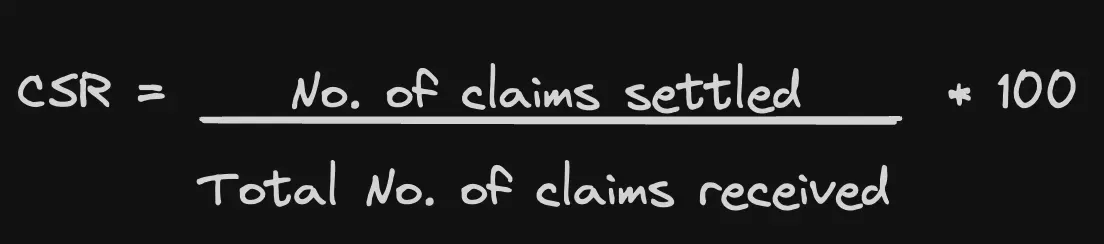

Claim Settlement Ratio (CSR)

Explanation: This is the % of claims an insurer has settled out of the total claims they received in that year. It gives you an idea of how likely it is that your claim will be paid if you file one with that insurer.

CSR formula.webp

Example: If an insurer has a claim settlement ratio of 95%, it means it has settled 95 out of every 100 claims.

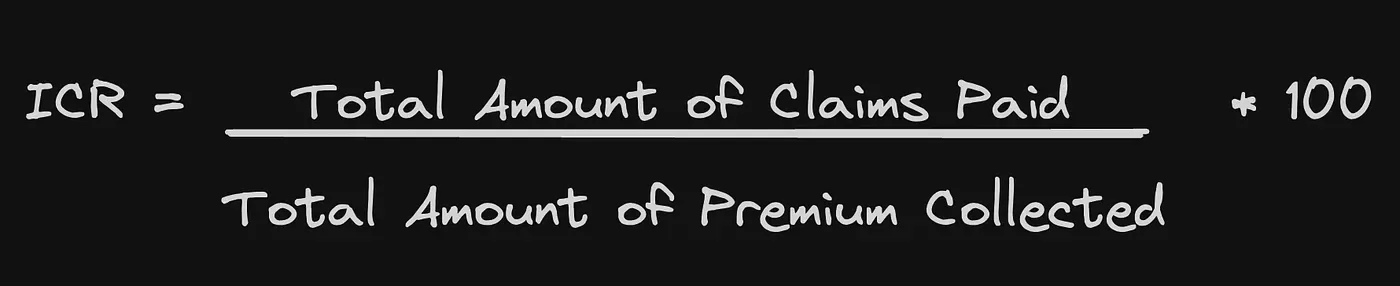

Incurred Claim Ratio (ICR)

Explanation: It is a measure of the total amount of claims paid by the insurer in a year relative to the total premium collected in that year. It shows the financial health of the insurer.

ICR Formula.webp

Example: If an insurer collected ₹100 crores in premiums and paid out ₹80 crores in claims, the ICR would be 80%.

FAQ: What does the ICR tell me?

- Above 100%: The insurer is paying out more in claims than it collects in premiums. This is not sustainable long-term indicating a high chance of a claim rejection.

- Between 50% to 100%: The insurer is financially healthy and likely to pay claims.

- Below 50%: The insurer collects much more than it pays out. While this might be good for the insurer, it could mean higher chances of claim rejection for the policy holder.

Surrender Value

Explanation: The surrender value is the amount of money you get if you decide to cancel a life insurance policy before it matures. It's like getting a partial refund on the premium that you've paid over the years.

FAQ: How is the surrender value calculated?

The surrender value is usually a percentage of the total premiums you've paid, minus any charges or fees. It depends on how long you've held the policy, the type of policy, and the insurer's rules. There are generally two types of surrender value:

- Guaranteed Surrender Value: The minimum amount you'll get back if you surrender the policy.

- Special Surrender Value: This might be higher than the guaranteed value, depending on factors like the policy's duration and bonuses.

Let's take an example: Say you have a life insurance policy with a sum assured of ₹10 lakhs, and you've been paying an annual premium of ₹50,000 for 10 years (₹5,00,000). After 10 years, you decide to surrender the policy.

- If the policy has a guaranteed surrender value of 30% of the premiums paid, you might get back ₹1,50,000 (30% of ₹5,00,000).

- If the insurer offers a special surrender value, and it's 50%, you might get back ₹2,50,000 instead.

Micro-insurance

Explanation: This type of insurance is designed to be affordable and accessible for low-income individuals or groups, typically covering specific risks like health, crop failure, or natural disasters. The coverage amounts are smaller, and the premiums are low, making it accessible to people who might otherwise not afford insurance.

Example: A daily wage worker might purchase micro-insurance that covers medical expenses up to ₹10,000 in case of an accident or illness, for a very small premium.

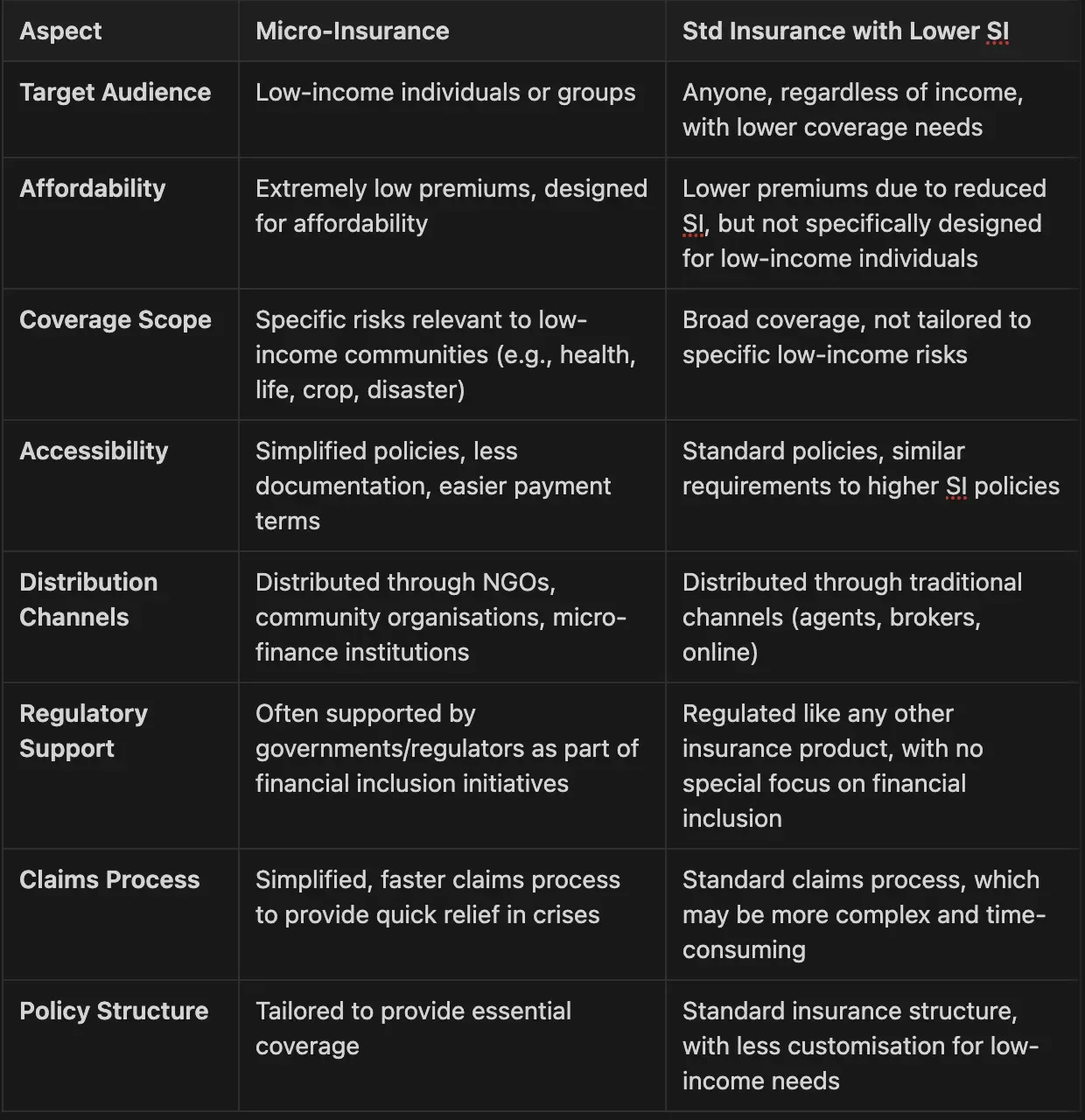

FAQ: Isn't micro-insurance just a std insurance with a lower SI limit?

Not really. There are some key differences that should help you understand it better.

Micro-insurance vs Std Insurance

Floater Policy

Explanation: A floater policy is like a safety net that covers multiple things or people under one policy. It's flexible and "floats" to cover whoever needs it at the time.

Example: Imagine you have a family health insurance floater policy worth ₹10 lakhs which covers you, your spouse and your parents. Now, you can either distribute and use the amount equally or if needed, the entire amount can also be "floated" to any one who may need to pay a big hospital bill.

Endorsement

Explanation: An endorsement is like adding a note to your insurance policy that says, "Hey, we've changed something!" It could be big or small, but it's an official way to modify your existing policy.

Example: Let's say you bought insurance for your house. Later, you add a fancy new sofa. An endorsement would be like telling your insurer, "Hey, I've got this new sofa. Can we make sure it's covered too?"

Conclusion

Thanks for sticking around till the end! While we've covered a lot of ground today, there are still a few nuggets of insurance wisdom we didn't quite get to — like CD balance, the difference between gross & net written premiums, and some motor-specific terms like IDV, Third-Party Liability etc. I may (most probably won't) cover them in a later instalment. In case I missed something crucial, please feel free to reach out to me.

Till then, stay curious, stay covered, and don't forget to read the fine print — that's where all the fun stuff hides!

Until next time, may your premiums be low, your coverage be high, and your claims process be smoother than a freshly waxed slide.

Insurance out! 🎤💧

Let's Connect

Found this interesting? I'd love to hear your thoughts or discuss product ideas.